Medical Benefits

Welcome

Bensonwood and Unity offers a health insurance plan administered by Point C. The plan uses the the Cigna provider network.

Eligibility

All employees working 30 or more hours per week are eligible to enroll in health insurance. Eligibility for newly hired, hourly employees is following 90 days of full-time employment.

Benefit Information

How do I enroll?

All employees must log into their Arcoro Benefits portal using their Bensonwood or Unity Email. If you encounter any issues logging in, please contact HR.

Just a reminder: In addition to new hire enrollment, Open Enrollment is your opportunity to make new benefit elections or modify your current benefit elections. If you miss the enrollment window, you must wait until the next open enrollment period unless you experience a qualifying life event.

Waiving or Declining Health Insurance

Remember, if you are eligible for health insurance but will not be enrolling due to having alternative coverage or choosing not to have insurance, you must sign a waiver form during the enrollment period.

If you choose not to enroll, you will not be able to join the plan until the next Open Enrollment period, unless there is a “qualifying event.” A Qualifying Life Event is a life-changing situation that allows you to make changes to your benefit elections outside of the normal Open Enrollment period. Examples of Qualifying Life Events include the birth of a child, marriage, divorce, and loss of other coverage.

All employees should be aware of possible Federal tax penalties for declining Bensonwood’s health insurance plan enrollment, as well as alternatives for health insurance available through the Health Insurance Exchange. For more information about declining health insurance, see: https://www.healthcare.gov/get-coverage/ and http://www.valuepenguin.com/ppaca/exchanges/nh.

What happens if I leave Bensonwood/Unity?

Under certain circumstances, you and your dependents may continue to participate in health coverage, dental insurance, and the Medical Flexible Spending Account through the Consolidated Omnibus Budget Reconciliation Act (COBRA). COBRA is a federal guarantee of the continuation of health insurance plan coverage after employment ends, which allows you to remain on medical and dental coverage, at the employee’s expense, for up to 18 or 36 months, depending on the circumstances. Former employees who enroll via COBRA will be responsible for the full cost of the monthly premiums.

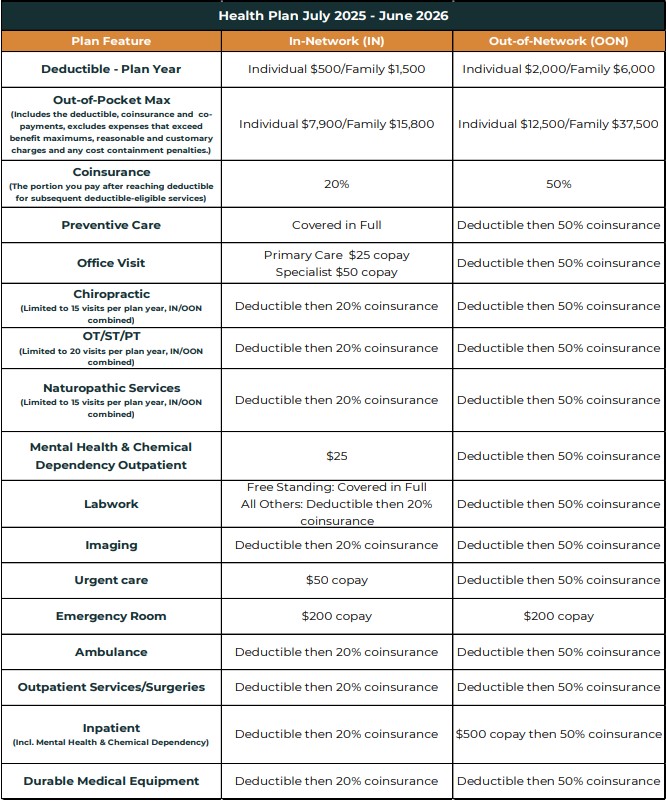

Summary of Benefits & Coverages

There are three major components of a Health plan.

Network – Bensonwood/ Unity’s Health plan, administered by Point C, uses the Cigna network.

- For a list of the participating In-network providers,

visit www.mycigna.com.

Cost To Use – For in-network services, you will have copays for office visits, outpatient mental health and emergency care. You will be responsible for meeting the deductible for most other in-network and out-of-network services, before the plan begins to pay. Once the deductible has been met, you will pay 20% coinsurance for most in-network services and 50% for out-of-network services. Coinsurance will be paid until the Out-of-Pocket Maximum (OOP) has been met. The Out-of-Pocket maximum refers to the most you will pay for covered expenses under the plan. You will experience a much higher OOP for Out-of-Network services.

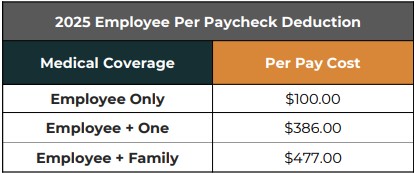

Cost To Own – The amount that will be deducted from each paycheck is listed below.

Contributions & Rates

The chart below shows the weekly payroll deduction for various coverage levels of each plan.

Carrier Contact Information

Plan Documents

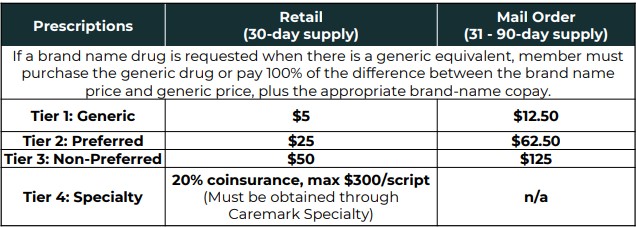

Prescription Coverage

Prescription Drug Plan

Maximum Out of Pocket (MOOP): $7,900 Individual / $15,800 Family

The plan year MOOP applies to pharmacy and medical claims. Each individual family member must meet the single MOOP unless the family MOOP has been met by any two or more covered family members. Once met, your covered prescriptions are paid at 100%. Generic dispense as written penalties do not apply to the MOOP.

Specialty Medications: Specialty medications must be ordered through Caremark Specialty Pharmacy at 1-800-237-2767. Medications are limited to a 30-day supply and may require prior authorization.

Generic Policy: If your doctor writes a prescription stating that a Generic may be dispensed, we will only pay for the Generic drug. If you choose to buy the Brand name drug in this situation, you will be required to pay the Brand copay plus the difference in cost between the Generic and Brand name drug. The Generic Policy does not apply if your doctor requires a brand name medication.

Maintenance Medication Coverage: The Prescription Drug Card Program will only cover maintenance medications through the Caremark Mail Order pharmacy or your local CVS pharmacy. Maintenance medications are those that treat an ongoing condition such as high blood pressure, diabetes or contraception. You can get up to two fills (original and 1 refill) from your local participating pharmacy. After that, the program will cover the medication ONLY if you order it from the Caremark Mail Order pharmacy or a local CVS pharmacy.

Drugs covered may be subject to Utilization Management which may include prior authorization and/or quantity limits. Please contact Member Services at 1-800-334-8134 if you have specific drug questions or register at caremark.com to check coverage.

For general questions contact RxBenefits at RxHelp@rxbenefits.com

Forms and Plan Documents

Flexible Spending Accounts (FSA) and Dependent Care Accounts (DCA)

Medical Flexible Spending Account (FSA)

What is a Medical Flexible Spending Account? A Medical FSA is a tax-advantaged employee benefit that allows eligible employees to voluntarily set aside pre-tax dollars through equal payroll deductions to be used for eligible health care expenses.

Who is eligible? The medical FSA is available to all regular full-time employees, working 30 or more hours per week, whether or not they participate in Bensonwood/Unity’s Health insurance. For new hourly employees, eligibility begins on the first of the month, following the 90 days of employment.

Eligible employees may elect to contribute up to $3,300 in 2025.

Medical FSA Basics

- Medical FSAs are used to set aside money for planned or reoccurring qualified medical expenses that are not covered by insurance, such as dental care, vision care, contact lenses, co-pays, deductibles, out-of-network expenses. For a list of qualified expenses visit: : https://www.irs.gov/forms-pubs/aboutpublication-502 and view the most current revision of Publication 502.

- Under the Coronavirus Aid, Relief and Economic Security Act (CARES Act), the definition of a qualifying medical expense now includes certain over-the-counter (OTC) medications and products. For some examples of these products, see the “Expanded FSA Expense” flyer.

- You have full access to your total election amount on the 1st day of that plan year. You do not need to wait until your FSA payroll deductions equal the amount of your qualified medical expense.

- Most transactions can be paid at the point of sale with a debit card pre-loaded with your total FSA amount for that plan year.

- You may carry $660 or less into the next plan year. Any remaining funds exceeding $660, would be forfeited.

What is the most I can contribute?

- $3,300 for plan year (2025)

- Payroll deductions are based on 26 paychecks per year.

- For new employees enrolling after January 1, the maximum allowable amount to be set aside is prorated. Payroll deductions will be based on the remaining number payroll checks in the plan year.

Dependent Care Account (DCA)

What is a Dependent Care Flexible Spending Account?

A dependent care FSA (DCA) allows employees to set aside pre-tax dollars to pay for daycare expenses for your children under 13, or qualifying dependents. To qualify for a DCA, the IRS requires that both spouses be employed or full-time students.

The amount you may contribute to the dependent care FSA is $5,000, if single or married filing jointly; $2,500, if married and filing separately.

Please note that the DCA is 100% employee funded and is only available to use as monetary contributions are made.

Eligible Daycare Expenses :

- Childcare or Adult Care by a licensed childcare facility, for children under 13 years of age who qualify as tax dependents.

- Childcare or Adult care for children or adults of any age who are physically or mentally unable to care for themselves and qualify as dependents.

Ineligible Daycare Expenses :

- Educational expenses including kindergarten or private school tuition fees

- Amounts paid for food, clothing, sports lessons, field trips, and entertainment

- Overnight camp expenses

- Transportation expenses

- Child Support payments

For additional information, please contact csONE Benefit Solutions at 888-227-9745 x2040 or email at flexiblebenefits@csONE.com.

Visit https://www.irs.gov/forms-pubs/about-publication-503 for a comprehensive list of eligible expenses, federal laws and regulations.

Carrier Contact Information

Forms and Plan Documents

FSA Store

The Richards Group has entered into a partnership with Health-E Commerce, also known as the FSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending Account.

Did you know you could use your FSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

Dental Benefits

Eligiblity

All employees who work a minimum of 30 hours per week are eligible, first of the month, following 90 days of employment.

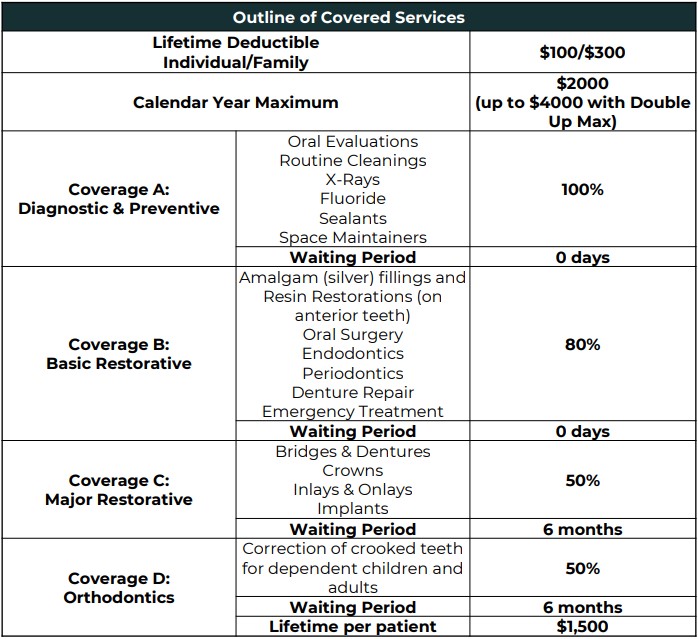

Summary of Benefits and Coverages

Plan Overview

Bensonwood/Unity offers it’s employees the PPO Plus Premier plan through Northeast Delta Dental. The plan covers Preventive Care, Minor and Major Restorative procedures, as well as Orthodontics.

The chart below provides a high level overview of the dental plan design and features offered to eligible employees by Bensonwood/Unity.

When considering whether purchasing dental insurance makes sense for you and your family, there are three things you should consider:

Network – Northeast delta dental has an extensive network. For a complete list of in-network dentists, visit https://portal1.nedelta.com/DentistSearch. In the “Network” field, enter “Delta Dental Premier”. If you visit a non-participating (Out-of-Network) dentist, you may be required to submit your own claim and pay for services at the time they are provided.

Cost to Use – There is no deductible for Preventive Services (Coverage A) or Orthodontia (Coverage D). For Basic services (Coverage B) and Major services (Coverage C) you will pay a one-time, Individual deductible of $100 or Family deductible of $300.

The annual maximum for the PPO plus Premier plan is $2,000 per member. The annual maximum may be increased to as much as $4,000 per person with the Double-Up Max program. See the attached Double-Up Max flyer for more information.

After meeting the deductible, you will be responsible for 20% of the cost of in-network Basic services, 50% of Major services, and 100% of all services once you’ve reached your annual max of $2,000, unless you benefited from the Double-Up Max rollover provision. You would be responsible for orthodontia costs beyond $1,500 per member, per lifetime.

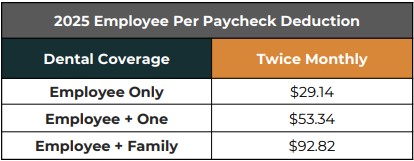

Cost to Own – What will your per paycheck deduction be? The amount that will be deducted from each paycheck is listed below.

Contributions & Rates

Enrolled employees pay premiums through payroll deductions, over 26 pay periods.

With Dental Insurance, it might be helpful to conduct a cost-benefit analysis for yourself and your family before enrolling. Once you’ve determined your annual cost to own the insurance, based on the premium chart above, consider the following:

- How often do you and your family members receive preventive dental care?

- Do you expect to need major, non-cosmetic dental work in the coming year?

- Do you have a dentist you know and trust that is included in this plan’s network?

- Would making tax favorable elections/contributions to an FSA be a less expensive way for you to pay for dental care?

Carrier Contact Information

Northeast Delta Dental: Dental Insurance

Customer Service: 800-832-5700

Website: www.nedelta.com

Plan Documents

Vision Benefits

Eligiblity

All employees who work a minimum of 30 hours per week are eligible, first of the month, following 90 days of employment.

Summary of Benefits and Coverages

Plan Overview

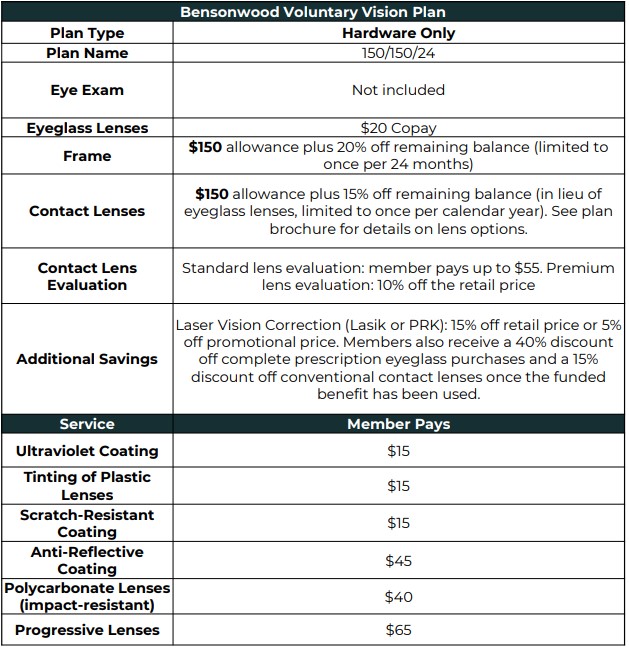

Bensonwood/Unity offers it’s employees an opportunity to enroll in a voluntary vision plan through Delta Dental operating on the nationwide EyeMed Vision Care Access Network.

This plan provides hardware benefits only.

To locate a participating EyeMed Access Network provider, log on to https://eyedoclocator.eyemedvisioncare.com/nedd/en or call 1-866-723-0513.

The chart below provides a high level overview of the vision plan design and features offered to eligible employees by Bensonwood/Unity.

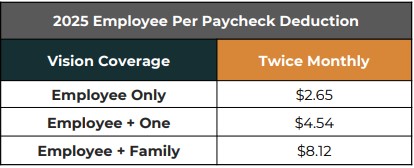

Contributions & Rates

Enrolled employees pay premiums through payroll deductions, over 26 pay periods.

Carrier Contact Information

![]()

DeltaVision: Vision Insurance

Customer Service: 866-723-0513

Website: www.eyemed.com

Plan Documents

Group Life Insurance

Eligibility

Employees who work 30+ hours per week are eligible on the first of the month, following 90 days of employment.

Summary of Group Basic Life and AD&D Benefits and Coverages

Group Basic Life

COVERAGE:

Benefits are 1x salary to a maximum of $100,000.

AD&D: Amount is equal to life coverage

PORTABILITY: You may continue the policy for you and your spouse at the same group rates if your employment ends. The policy continues until the employer’s policy cancels.

REDUCTION SCHEDULE:

AGE:

65-69 65% of original coverage amount

70-74 50% of original coverage amount

75-79 35% of original coverage amount

80+ 20% of original coverage amount

Voluntary Supplemental Life

COVERAGE:

Employee: Benefits available in increments of $5,000, up to the lesser of $500,000 or 7x earnings.

Spouse: Benefits available in increments of $5,000, not to exceed 50% of the employee amount, up to a maximum of $150,000.

GUARANTEE ISSUE: Only applies during initial enrollment period.

Employee: $150,000

Spouse: $25,000

PORTABILITY: You may continue the policy for you and your spouse at the same group rates if your employment ends. The policy continues until the employer’s policy cancels.

REDUCTION SCHEDULE:

AGE:

65-69 65% of original coverage amount

70-74 50% of original coverage amount

75-79 35% of original coverage amount

80+ 20% of original coverage amount

Coverage ends at retirement if occurring prior to age reductions.

AD&D: Amount is equal to life coverage and not available on dependent life plans. Rate is $.03 per $1,000.

Carrier Contact Information

Symetra: Life and AD&D

Customer Service: 800-796-3872

Website: www.symetra.com

Forms & Plan Documents

Evidence of Insurability Forms

STD Coverage

Eligibility

Employees who work 30+ hours per week are eligible on the first of the month, following 90 days of employment.

Voluntary Short-Term Disability

Elimination Period: Benefits begin on the 15th day after an Accident, or 15th day after an illness

Max Benefit Duration: 13 weeks

Maximum Benefit: 66 2/3% of salary or $1,250

Minimum Benefit: $50

- As long as an employee remains enrolled, the premium payable for the selected insurance coverage will always be based upon the employee’s age at the time of original enrollment.

- Program includes $10,000 Accidental Death and Dismemberment (AD&D) coverage.

Note: There is a pre-existing condition limitation that applies to new enrollees for the 1st 12 months of coverage

Carrier Contact Information

Forms & Plan Documents

401(k) Retirement Plan

Eligibility

401(k) Plan Details

Bensonwood/Unity’s retirement plan is administered by Empower Retirement. Associates are eligible after 1 year of service if they are at least 18 years of age. The company may match up to one-third of the first 6% when profits can support the match.

The online portal is: https://regn.lincolnfinancial.com/ent-ui-registration/index.html#/

Associates are given an enrollment code and walk through the prompts to enroll themselves in either a Traditional or Roth 401k.

Upon departure, associates with a vested balance may leave their 401k within the plan (though we do not prefer it), or they may request a rollover or withdrawal on the online portal. If the vested account balance is $1,000 or less and the distribution form is completed within 30 days, then the benefit will be distributed to the associate and will be subject to federal and state income taxes. Associates may also incur an early withdrawal penalty on the amount distributed. If the vested account balance is more than $1,000 but less than $5,000, if the form is not completed within 30 days, the benefit will then be rolled over to an IRA established by the plan on the associate’s behalf through Millennium Trust.

Retirement 401(k): Lincoln Financial Group

Participant Services: 800-510-4015

Website: www.http://www.lincolnfinancial.com

Employee Assistance Program (EAP)

Eligibility

This program is available to all employees and their household family members.

Plan Details

Bensonwood/Unity promotes the health of employees and their household members by offering immediate access to free, confidential counseling through Invest EAP, for a wide range of life issues. This program is available to all employees and their family members.

Invest EAP is a Vermont-based public and private non-profit collaborative that has offered comprehensive Employee Assistance Program (EAP) services since 1986. Invest EAP provides short-term counseling and referral, management consultation, wellness workshops and resource information.

Invest EAP’s comprehensive confidential services include:

- 24/7 telephone access to counselors

- In-person counseling sessions

- Management consultation

- Counseling, resource and referral information to address issues involving:

- Relationships and Family

- Drug and Alcohol

- Mental Health

- Grief and Loss

- Medical

- Disability

- Eldercare

- Childcare

- Parenting Techniques

- Workplace Conflict

- Legal Issues

- Financial Problems

- Wellness workshops

- Critical Incident Stress Debriefings

- Facilitated discussions

- Organizational development

- Workplace wellness program development

- Much, much more!

Need Assistance?

Go to: www.investeap.org

Call:1-866-660-9533

EAP: Invest EAP

Participant Services: 866-660-9533

Website: www.investeap.org

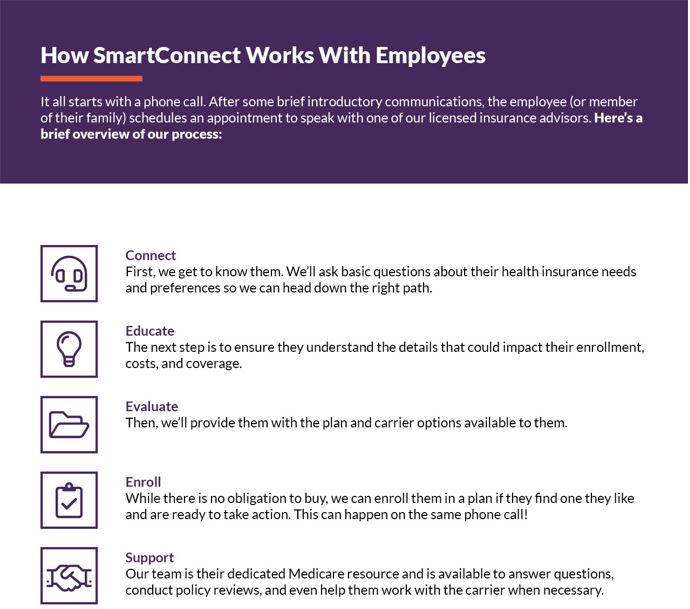

SmartConnect- Medicare Resource

The Richards Group has partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether an employee plans to continue working or is transitioning to retirement, we tailor solutions designed around their needs. Our agents provide an unfiltered view of the entire range of options and prices available to the employee.

SmartConnect Contact Information

For more information or to get started, please click on the following link: https://gps.smartmatch.com/

Additional Information

My Tuition Assistance Benefits

Our tuition assistance program is designed to help employees pay back student loan debt and improve their financial well-being.

Utilizing the relationship with The Richards Group, consultation services provided through GradFin are provided free of charge. GradFin is a new employee benefits program revolutionizing how employees can reduce their student loan debt.

GradFin will provide:

- One-on-one education consultations with GradFin Consultation Experts to review your current loan status and discuss personalized payoff options to save on your loans.

- GradFin will offer a competitive interest rate reduction when you refinance your loans.

- GradFin will offer the lowest interest rates in the industry through their lending platform which is made up of ten lenders to maximize the chances that you will be approved for a new loan.

- For more information or to schedule a one-on-one consultation visit: http://www.gradfin.com/platform/trg

The Wellness Outlet

We offer our employees discounts through the Wellness Outlet!

Enter account code RICHARDSGRP at The Wellness Outlet for access to discounts of 18-40% off retail price of fitness trackers from Fitbit and Garmin, plus free shipping to your home.

Website: https://www.thewellnessoutlet.com/